- Augury ⍺ 🟢

- Posts

- 🟢 3.2.1. Augury (1)

🟢 3.2.1. Augury (1)

Looking for unbiased, fact-based news? Join 1440 today.

Upgrade your news intake with 1440! Dive into a daily newsletter trusted by millions for its comprehensive, 5-minute snapshot of the world's happenings. We navigate through over 100 sources to bring you fact-based news on politics, business, and culture—minus the bias and absolutely free.

3 Stocks (On The Move and Why).

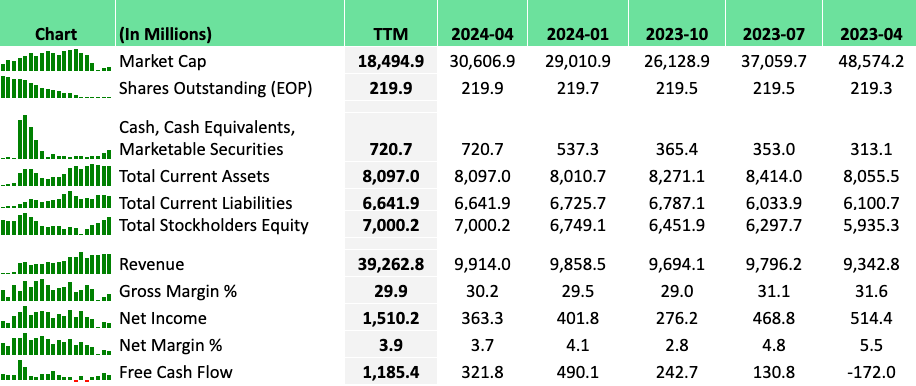

DG: Dollar General Q2: Sales up 4.2%, EPS down 20.2%, FY2024 guidance lowered

What's new: Dollar General reported Q2 FY2024 results with net sales up 4.2% to $10.2 billion, but diluted EPS down 20.2% to $1.70. The company has updated its financial guidance for fiscal year 2024, lowering expectations for sales growth and EPS.

Why it matters: Despite positive sales growth and customer traffic, Dollar General is facing challenges with profitability and core customer spending, prompting strategic actions to enhance value and in-store experience.

By the numbers:

Q2 net sales: $10.2 billion, up 4.2%

Same-store sales: Up 0.5%

Operating profit: $550.0 million, down 20.6%

Diluted EPS: $1.70, down 20.2%

Inventory: Down 11.0% on a per-store basis

Between the lines: Dollar General is seeing growth in consumables but declines in seasonal, home, and apparel categories. Gross profit margin decreased due to increased markdowns, inventory damages, and shrink.

What they're saying: CEO Todd Vasos acknowledged the company is "not satisfied" with the financial results and is "taking decisive action" to enhance offerings and in-store experience.

What to watch:

Updated FY2024 guidance: Net sales growth 4.7% to 5.3% (down from 6.0% to 6.7%)

New EPS guidance: $5.50 to $6.20 (down from $6.80 to $7.55)

Planned 2,435 real estate projects, including 730 new store openings

The bottom line: Dollar General is facing headwinds from a constrained core customer base and operational challenges, leading to a more cautious outlook for the remainder of the fiscal year.

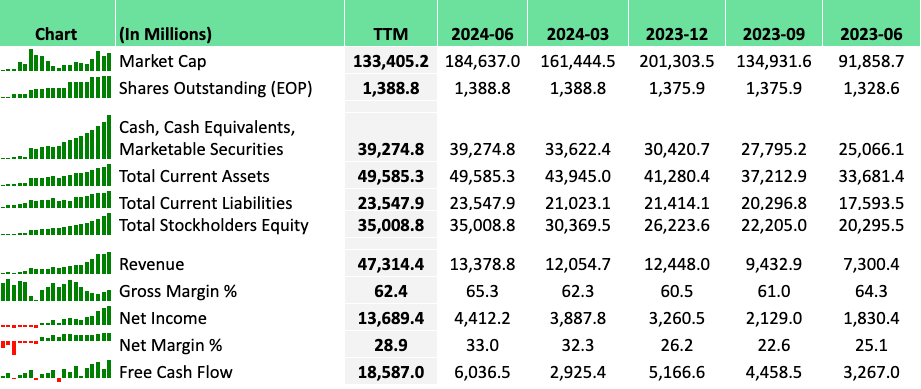

PDD: Q2 Revenue surges 86%, profit up 144%, warns of future challenges

What's new: PDD Holdings reported strong Q2 2024 results with total revenues up 86% to RMB97.1 billion ($13.4 billion) and net income up 144% to RMB32 billion ($4.4 billion). However, the company warns of upcoming challenges and potential decline in profitability.

Why it matters: Despite impressive growth, PDD Holdings is signaling a strategic shift towards "high-quality development" and a sustainable ecosystem, which may impact short-term financial performance.

By the numbers:

Total revenue: RMB97.1 billion ($13.4 billion), up 86%

Operating profit: RMB32.6 billion ($4.5 billion), up 156%

Net income: RMB32 billion ($4.4 billion), up 144%

Diluted earnings per ADS: RMB21.61 ($2.97), up from RMB9.00 in Q2 2023

Cash and equivalents: RMB284.9 billion ($39.2 billion)

Between the lines: Revenue growth is slowing quarter-over-quarter, and the company expects further pressure due to intensified competition and external challenges.

What they're saying:

Chairman Lei Chen: "We are prepared to accept short-term sacrifices and potential decline in profitability."

Co-CEO Jiazhen Zhao: "We will vigorously support high-quality merchants while firmly tackling low-quality ones."

What to watch:

Investments in platform trust and safety

Support for high-quality merchants

Potential impact on profitability due to strategic investments

The bottom line: PDD Holdings is pivoting towards long-term sustainability at the expense of short-term gains, signaling a significant strategic shift for the e-commerce giant.

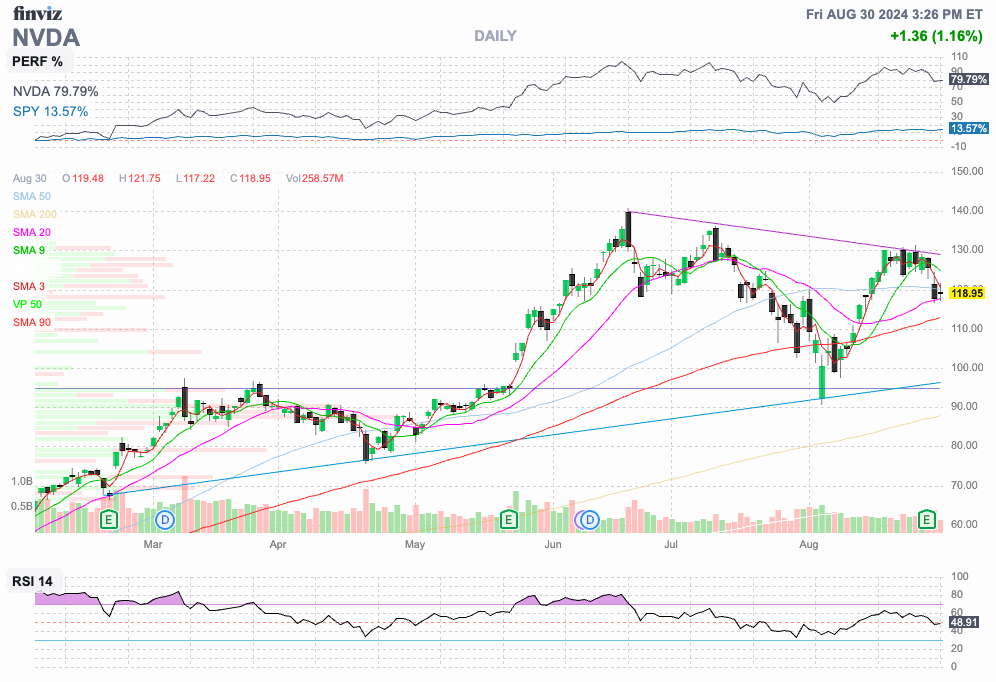

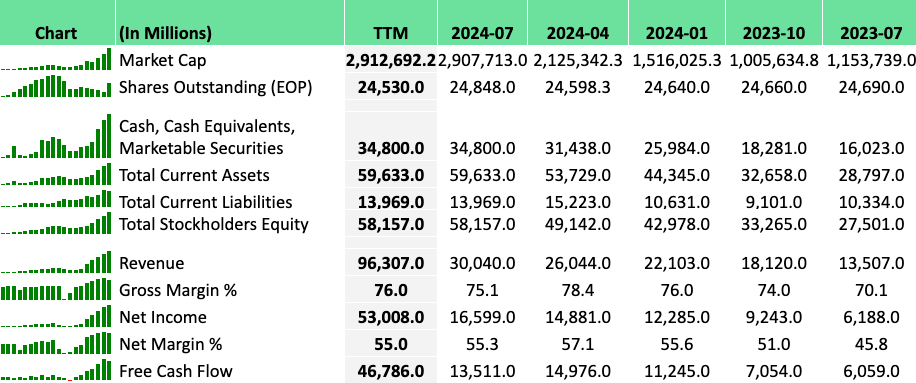

NVDA: NVIDIA Q2 FY2025: Revenue soars 122% to $30B, Data Center revenue up 154%

What's new: NVIDIA reported record Q2 FY2025 results with total revenue of $30 billion, up 122% year-over-year, driven by strong demand for AI and accelerated computing solutions.

Why it matters: NVIDIA's stellar performance underscores the explosive growth in AI and data center markets, with the company positioning itself as a full-stack, data center-scale platform provider.

By the numbers:

Total revenue: $30.0 billion, up 122% YoY

Data Center revenue: $26.3 billion, up 154% YoY

GAAP EPS: $0.67, up 168% YoY

Non-GAAP EPS: $0.68, up 152% YoY

Q3 revenue outlook: $32.5 billion (±2%)

Between the lines: Strong demand for Hopper architecture and high anticipation for Blackwell are driving growth. New product categories like Spectrum-X Ethernet and NVIDIA AI Enterprise software are gaining significant traction.

What they're saying: CEO Jensen Huang emphasizes the company's role in modernizing computing stacks for generative AI across various sectors.

What to watch:

Blackwell architecture rollout

Enterprise adoption of generative AI solutions

Expansion of share repurchase program by $50 billion

The bottom line: NVIDIA continues to capitalize on the AI boom, with expectations of continued strong growth in the coming quarter.

2 Portfolio Builders.

Coming in September:

🟢 The Wealth Acceleration Workshop: I’m going over the three key ingredients to build wealth quickly.

Full strategy - Decrease risk and increase returns

Tools, templates and step by step process

Date: September 15th (Sunday) at 11:00 AM (EST)

If you want to join reply directly to this email: “Workshop”

🟢 The Moat Masterclass: I’m going over how to evaluate moats and releasing my newest stock pick.

Full step by step stock analysis (5x upside)

Deliverables included: The Ultimate Moat Checklist + Moat Masterclass Course

Date: September 22nd (Sunday) at 11:00 AM (EST)

If you want to join reply directly to this email: “Masterclass”

(Replays will be available if you cannot join live.)

1 Actionable Tip.

"Playing poker in the Army and as a young lawyer honed my business skills .. What you have to learn is to fold early when the odds are against you, or if you have a big edge, back it heavily because you don't get a big edge often."

Happy Investing, |  |

Where will NVDA be a year from now?Date 8/31/2024 | Price: $119.28 |