- Augury ⍺ 🟢

- Posts

- 🟢 3.2.1. Augury

🟢 3.2.1. Augury

Steal our best value stock ideas.

PayPal, Disney, and Nike all dropped 50-80% recently from all-time highs.

Are they undervalued? Can they turn around? What’s next? You don’t have time to track every stock, but should you be forced to miss all the best opportunities?

That’s why we scour hundreds of value stock ideas for you. Whenever we find something interesting, we send it straight to your inbox.

Subscribe free to Value Investor Daily with one click so you never miss out on our research again.

3 Stocks (On The Move and Why).

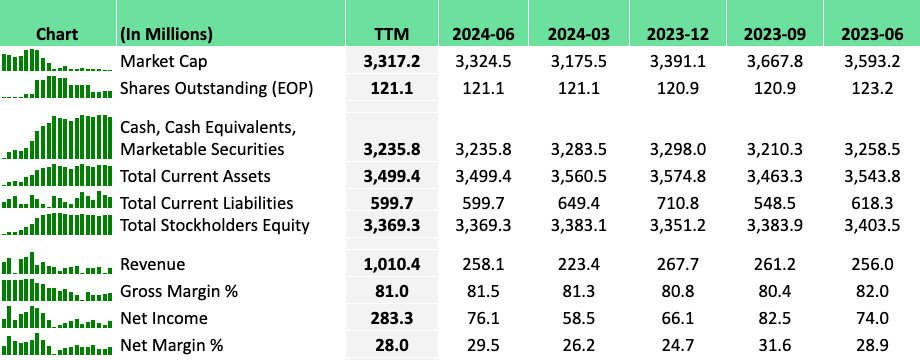

What's new: Autohome, China's leading online auto consumer platform, approved a $200 million share repurchase program over the next 12 months.

Why it matters: This move signals confidence in the company's financial health and aims to boost shareholder value amid market uncertainties.

How it works:

Repurchases can be made through open market, private transactions, or block trades

Funding comes from existing cash balance

Board will review program periodically, can adjust terms or suspend/discontinue

The big picture: As China's auto market evolves, Autohome is positioning itself as a strong player, using its cash to potentially increase earnings per share and stock price.

What to watch: Market reaction to this announcement and any changes in Autohome's stock performance over the coming months.

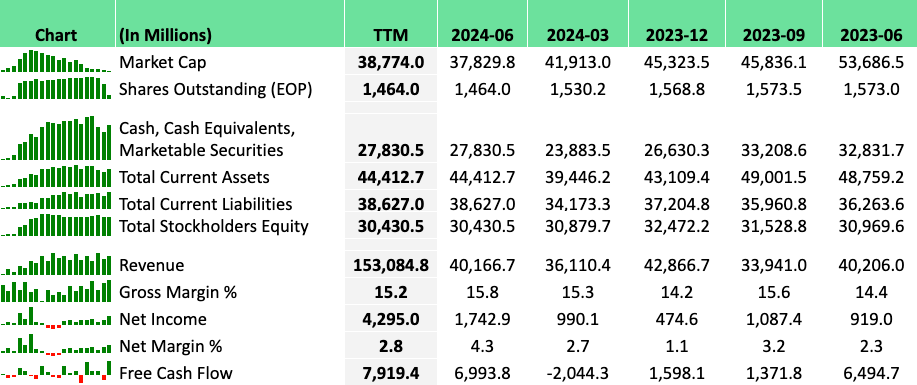

What's new: JD.com's board approved a $5 billion share repurchase program, starting September 2024 and running through August 2027.

Why it matters: This move signals confidence in the company's long-term value and could potentially boost stock prices by reducing the number of outstanding shares.

How it works:

Repurchases can be made on the open market, through private transactions, or block trades

The board will review the program periodically and may adjust terms and size

Program covers both ordinary shares and American Depositary Shares (ADSs)

The big picture: As a leading supply chain-based technology provider, JD.com's significant buyback plan reflects its strong financial position in the competitive Chinese e-commerce market.

What to watch: Market reaction to this announcement and any future adjustments to the repurchase program.

Go deeper: JD.com trades on NASDAQ (JD) and Hong Kong Stock Exchange (9618 HKD counter, 89618 RMB counter).

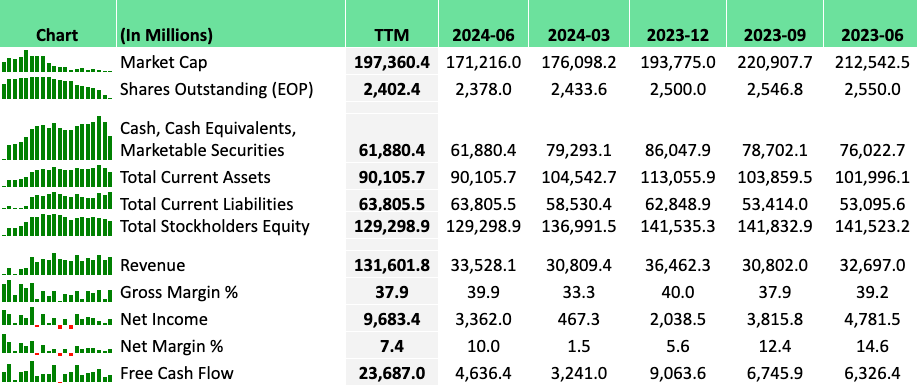

BABA - Alibaba's WeChat Pay move — Market expansion strategy amid e-commerce challenges

What's new: Alibaba's Taobao and Tmall platforms now accept WeChat Pay, marking a significant shift in China's e-commerce landscape.

Why it matters: This move could help Alibaba expand its market share, especially in less developed areas of China, as it faces intense competition and slowing growth.

By the numbers:

WeChat boasts over 1.3 billion global users, mostly in China

Alibaba's stock is down 13% in the last 12 months

Q1 revenue grew 4% YoY to $33.47B, missing analyst estimates

The big picture: Alibaba is seeking new growth avenues amid a challenging e-commerce environment in China:

Intense domestic competition and price wars have impacted performance

Taobao and Tmall Group revenue decreased by 1% to $15.60B in Q1

What's next:

New "digital technology" company focusing on imports/exports, groceries, and tech services

Potential market share growth in less developed parts of China

Between the lines: This move follows the end of a three-year regulatory crackdown, signaling a possible shift in Alibaba's strategic priorities.

2 Portfolio Builders.

Coming in September:

🟢 The Wealth Acceleration Workshop: I’m going over the three key ingredients to build wealth quickly.

Full strategy - Decrease risk and increase returns

Tools, templates and step by step process

Date: September 15th (Sunday) at 11:00 AM (EST)

If you want to join reply directly to this email: “Workshop”

🟢 The Moat Masterclass: I’m going over how to evaluate moats and releasing my newest stock pick.

Full step by step stock analysis (5x upside)

Deliverables included: The Ultimate Moat Checklist + Moat Masterclass Course

Date: September 22nd (Sunday) at 11:00 AM (EST)

If you want to join reply directly to this email: “Masterclass”

(Replays will be available if you cannot join live.)

1 Actionable Tip.

Happy Investing, |  |

Will you invest in China 🇨🇳(Results are live) |