- Augury ⍺ 🟢

- Posts

- 🟢 3.2.1. Augury

🟢 3.2.1. Augury

Get value stock insights free.

PayPal, Disney, and Nike recently dropped 50-80%. Are they undervalued? Can they recover? Read Value Investor Daily to find out. We read hundreds of value stock ideas daily and send you the best.

3 Stocks (On The Move and Why).

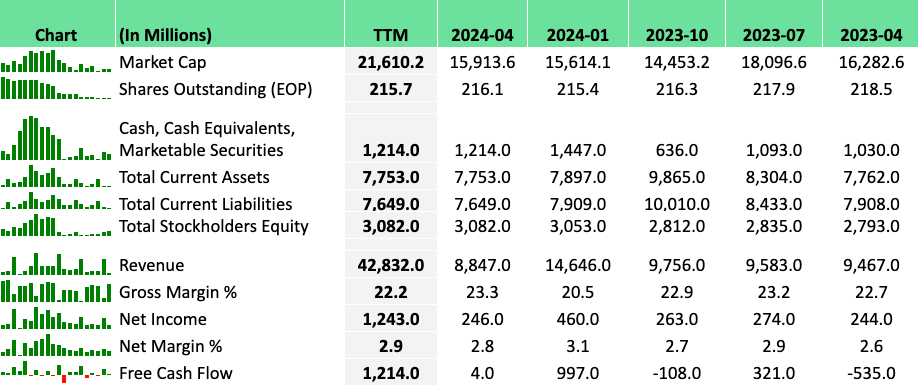

BBY: Best Buy Q2 results: Sales down, EPS up, FY25 outlook improves

What's new: Best Buy reported Q2 FY25 results with comparable sales down 2.3%, but GAAP and non-GAAP diluted EPS up 7% and 10% respectively to $1.34. The company raised its FY25 non-GAAP diluted EPS guidance.

Why it matters: Despite a challenging retail environment, Best Buy is showing resilience with improved profitability and a more optimistic outlook for the full year.

The big picture: Best Buy is navigating a stabilizing but still uneven consumer landscape, balancing value-seeking customers with demand for high-end tech products.

By the numbers:

Q2 Domestic revenue: $8.62 billion, down 3.0%

Q2 International revenue: $665 million, down 4.0%

FY25 revenue guidance: $41.3 billion to $41.9 billion

FY25 comparable sales guidance: -3.0% to -1.5% (narrowed from previous -3.0% to 0.0%)

Between the lines: Strong performance in tablets and computing (6% comparable sales growth) helped offset declines in appliances, home theater, and gaming.

What they're saying: CEO Corie Barry emphasized the company's focus on "sharpening our customer experiences and industry positioning while expanding our non-GAAP operating income rate."

What's next: Best Buy expects Q3 FY25 comparable sales to decline by approximately 1.0% with a non-GAAP operating income rate of about 3.7%.

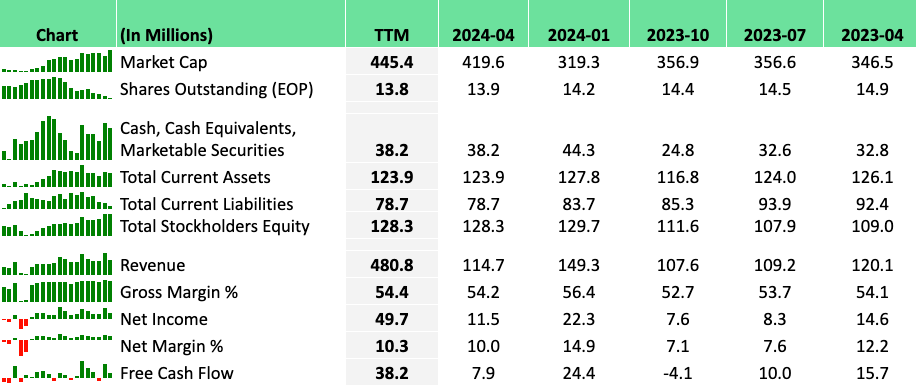

BBW: Build-A-Bear Q2: Revenue up 2.4%, EPS up 12.3%, FY2024 guidance reaffirmed

What's new: Build-A-Bear Workshop reported Q2 FY2024 results with revenue up 2.4% to $111.8 million and diluted EPS up 12.3% to $0.64. The company reaffirmed its fiscal 2024 guidance.

Why it matters: Despite challenges in e-commerce demand, Build-A-Bear demonstrated resilience with growth in total revenues and profitability, showcasing the strength of its transformed business model.

By the numbers:

Q2 revenue: $111.8 million, up 2.4%

Q2 pre-tax income: $11.5 million, up 10.2%

Q2 diluted EPS: $0.64, up 12.3%

E-commerce demand: Down 28.2%

Commercial and franchise revenues: $8.3 million, up 44.8%

Between the lines: The company's omnichannel strategy and global expansion are offsetting e-commerce headwinds, with strong performance in commercial and franchise segments.

What they're saying: CEO Sharon Price John highlighted "increasing momentum for our experience locations" and improved web demand in early Q3, supporting confidence in the annual guidance.

What to watch:

Net new unit growth: Targeting at least 50 new experience locations globally in FY2024

Share repurchases: Over 5% of outstanding shares repurchased year-to-date

The bottom line: Build-A-Bear is maintaining its growth trajectory despite challenges, focusing on brand leverage and profitable expansion across multiple channels.

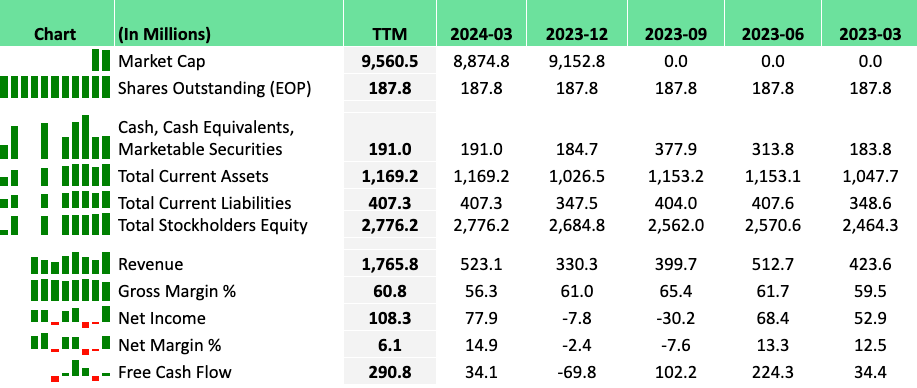

BIRK: Birkenstock Q3 FY2024: Revenue up 19%, confirms full-year guidance

What's new: Birkenstock reported record Q3 FY2024 revenue of €565 million, up 19% year-over-year, driven by strong consumer demand across all segments and channels.

Why it matters: The results demonstrate Birkenstock's resilience and growth potential as a newly public company, even as consumers become more selective in their spending.

By the numbers:

Q3 revenue: €565 million, up 19%

Net profit: €75 million, up 18%

EPS: €0.40, up 15%

Adjusted EBITDA: €186 million, up 15%

B2B revenue growth: 23%

DTC revenue growth: 14%

Between the lines: Birkenstock is expanding its product range and retail footprint, with closed-toe styles growing at twice the brand average and 7 new owned stores opened in Q3.

What they're saying: CEO Oliver Reichert emphasized the company's ability to meet consumer demand while maintaining a "disciplined engineered distribution approach."

What to watch:

Production capacity expansion: Temporarily impacting margins but setting up for future growth

Deleveraging: Company aims for 2x net leverage by end of calendar year

The bottom line: Birkenstock reaffirms FY2024 guidance of 20% revenue growth and 30-30.5% Adjusted EBITDA margin, signaling confidence in its growth trajectory.

2 Portfolio Builders.

Coming in September:

🟢 The Wealth Acceleration Workshop: I’m going over the three key ingredients to build wealth quickly.

Full strategy - Decrease risk and increase returns

Tools, templates and step by step process

Date: September 15th (Sunday) at 11:00 AM (EST)

If you want to join reply directly to this email: “Workshop”

🟢 The Moat Masterclass: I’m going over how to evaluate moats and releasing my newest stock pick.

Full step by step stock analysis (5x upside)

Deliverables included: The Ultimate Moat Checklist + Moat Masterclass Course

Date: September 22nd (Sunday) at 11:00 AM (EST)

If you want to join reply directly to this email: “Masterclass”

(Replays will be available if you cannot join live.)

1 Actionable Tip.

When struggling to think clearly about a problem try this 👇

Push the situation or problem to its extreme limits - either the best or worst possible outcome - to gain clarity and insight.

Why it works:

Clarifies Core Issues: By exaggerating the problem to its extreme, the fundamental aspects become more apparent. It strips away the noise and distractions, forcing you to confront the core issues directly.

Highlights Consequences: Extreme scenarios highlight the potential consequences of different actions. This can help you understand the stakes involved and prioritize what matters most.

Tests Assumptions: When you push a situation to its extreme, you're forced to test the assumptions you're making. If those assumptions break down under extreme conditions, it can reveal flaws in your thinking.

Facilitates Creative Problem-Solving: Extreme-case thinking can also spark creative solutions. By considering how to avoid the worst-case scenario or achieve the best-case scenario, you might come up with ideas you wouldn’t have considered otherwise.

Builds Resilience: This method helps prepare for the worst, making you more resilient in real-life situations. If you’ve already considered how to handle the extremes, you're less likely to be caught off guard by unexpected challenges.

(This concept is called extreme-case scenario thinking or extremity analysis.)

Happy Investing, |  |

Where will NVDA be a year from now?Date 8/31/2024 | Price: $119.28 |