- Augury ⍺ 🟢

- Posts

- 🟢 Don't Wait 30 Years to Build Wealth

🟢 Don't Wait 30 Years to Build Wealth

The two paths to building wealth in the stock market:

There are two paths to building wealth in the stock market:

Path #1: Invest in index funds and wait 30+ years, praying the tides of the market take you to where you want to get to.

Path #2: Take the self directed route and learn how to identify exceptional opportunities, size them properly, and accelerate your returns like young Warren Buffett did.

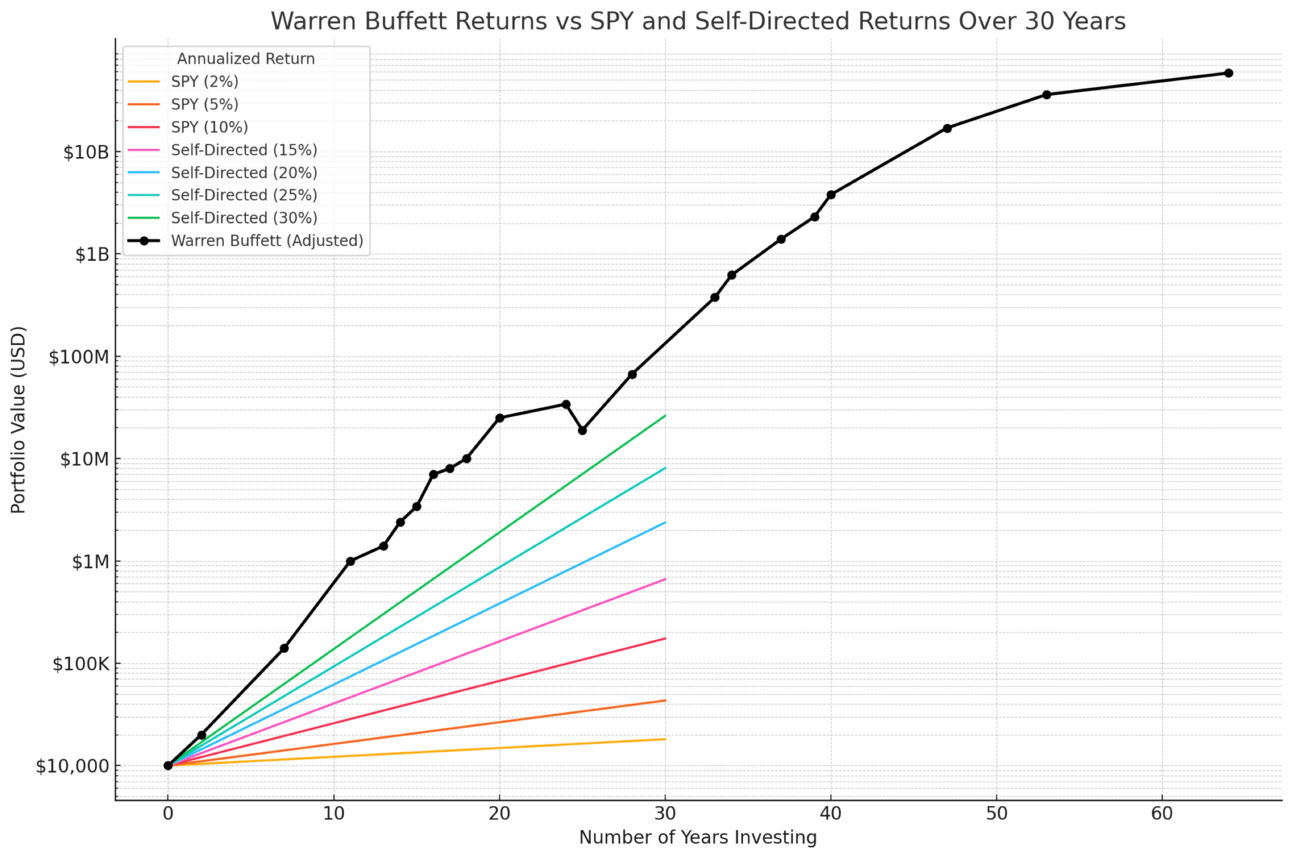

Look at the chart above. The difference between a 10% and 25% annual return isn't just mathematical - it's life-changing.

Starting with $10,000:

At 10% (SPY): $170,000 after 30 years

At 25% (Self-Directed): $8,000,000 after 30 years

Warren Buffett level elite: +$30,000,000,000

This isn't about taking unnecessary risks. It's about having a systematic framework for:

Identifying real edge

Sizing positions optimally

Accelerating returns safely

In the Wealth Acceleration Workshop, I break down exactly how I:

Find opportunities with 25%+ return potential

Calculate optimal position sizes

Know when to scale up/down allocations

Build conviction for larger positions

Most investors never learn these strategies. They're told to "diversify and wait" while the world's best investors concentrate their capital in their highest conviction ideas.

The complete framework, including:

My exact framework

Position Sizing Templates and tools

My Personal Investment Checklist

All for just $100. But this recording comes down Sunday night.

Here's what the next 90 days could look like:

Week 1: Master the framework

Week 2: Build your watchlist

Week 2-3: Execute your first high-conviction trades

Don't spend decades slowly building wealth when you could be accelerating your returns starting next week.

Get instant access here: [LINK]

Happy Investing, Tyler DuPont |  |

Talk soon, Tyler

P.S. The difference between 10% and 25% returns on $10,000 is nearly $8 million over 30 years. The workshop is $100. You do the math on that ROI. Access Now [LINK]